The last six months within the Melbourne Inner North and Inner West real estate markets have certainly been interesting! In my 20+ years in this market, I have seen many ups and downs, during which there are generally two or three indicators that have a serious impact on the rise or fall of property prices. This has increased to five identified key indicators that have affected all aspects of the current market, especially in the less affluent areas of my territory of influence under the BuyerX banner.

Lack of Supply

Historically, the market consistently has a flow of stock coming in. Since Covid, this key indicator has become quite skewed. In the last 6 months specifically, we saw supply levels continue to increase, but with a marked decrease in quality A grade stock. With C and D grade properties flooding the market, if you were after someone’s “bad” asset then options were a plenty. New apartments (5-15 years old) came on in throes, with investors either cashing in, or simply getting out due to the an inability to recoup through rental costs or lagging student demand against the hefty increases in interest rates. As landlords were hit on all counts, with rising interest rates, land tax and house compliance laws forcing them to upkeep their homes, they began getting rid of large numbers of old unrenovated or rental homes. It became far more appealing to move on, cash in, secure a more renovated home in a better location, or search in different markets.

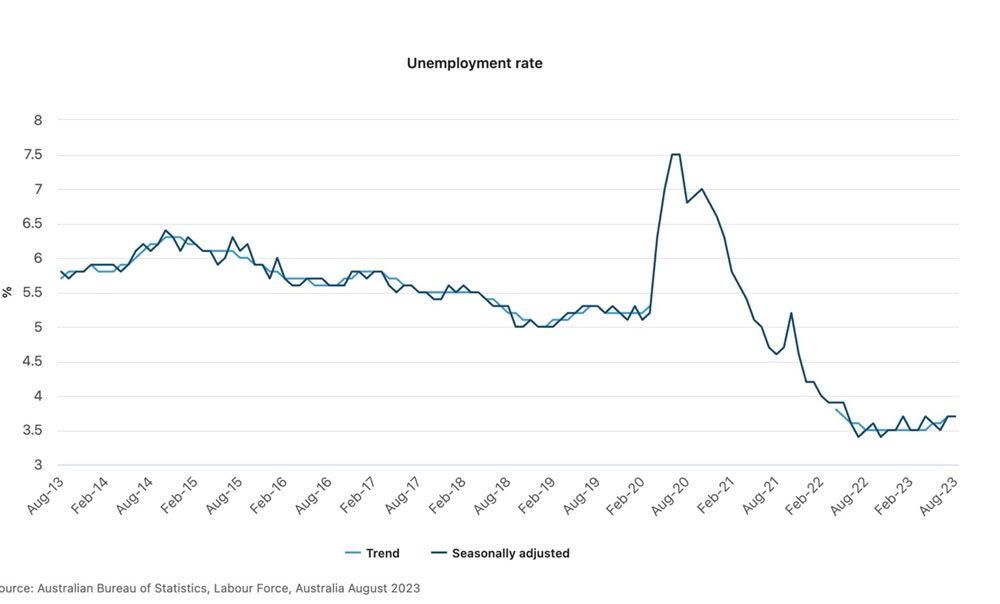

Unemployment

Job security played a big role in the market place, as it always has. Employment growth picked up in Victoria, with a number of new positions in a myriad of fields becoming available across the state. As this key factor continues to develop, consumer confidence will be positively affected. To be able to have job security, combined with a responsible level of borrowing to secure a first or upgrade to a family home, will leave many in good stead moving forward. The Melbourne Inner city market will and has always supported the decision to secure a home, which will only increase in value as long as you have a medium to long term view.

Interest Rates

The Reserve Bank of Australia lifted its cash rate to 4.35% during the final meeting for 2023 under new Governor Michelle Bullock, bucking the trend of the three successive month rate pauses prior. Despite the acknowledgment that inflation had officially passed its peak, it was projected that inflation would be around 3.25% by the end of 2024, and back within the intended corridor in late 2025.

Interest rates have always been a major factor in the direction of the real estate market. Apart from the control of inflation to achieve overall economic stability, it also significantly impacts both buyer consumer confidence and borrowing power. For example, if you were eligible to borrow $1m in January 2023, then the bank reassessed you again this quarter after rate hikes, you would then only have had $875,000 to work with, which before and after would have secured you a very different level of asset altogether. We spoke to a number of first home buyers that were looking for an inner city 2 bedroom single front that had been forced to reevaluate their expectations. Many of these buyers refocused towards a townhouse or villa unit, as long as it was still situated close to amenities like transport, shops, schools and the CBD. This meant that property prices adjusted to more realistic values than where they sat when interest rates were at 2%. Did the market go down, or were record low interest rates skewing perceived market prices?

Population Growth

Victoria’s population growth just keeps on keeping on! To March 2023, the state’s population increased by a staggering 161k year on year, bolstered by the combination of interstate relocations, new migrants, and a return of international students. Predictions are that Melbourne will overtake Sydney’s population in about 7-8 years. So how does this affect our market? Newcomers will flock to locations where they feel safe, are close to transport, main arterials, with shops and restaurants, and of course good schools. These newcomers have to live somewhere, the problem we have is that not enough houses are being built. This will create more competition for rentals, and will filter through to the home buying market, with a large percentage of this influx made up of professionals relocating to the area with jobs already lined up. Interstate and internationals buyers are cashed up and ready to buy. We are currently in negotiations with many clients ready to relocate from places like Sydney, Brisbane, Adelaide, and even Singapore. Population growth will have an instantaneous impact on demand vs lack of supply.

Lack of Construction

The devastating effects of Covid left a myriad of builders, both large and small, going broke and closing down. This year we have seen the real time fallout of this, with a halting or delay of completion of these projects and properties likely to impact the market for the next 12-24 months. Combined with an ever-increasing population growth, how are we going to house everyone? It just doesn’t add up!

Region Roundup

- Yarra

- Moonee Valley

- Hobsons Bay

- Maribyrnong

- Merri-Bek

- Banyule

Looking Ahead

In the inner city we inspect properties daily, attend auctions every weekend, and what we are seeing is a continued lack of quality stock, more and more buyers at open for inspections, and interestingly an increase in number of bidders at auction.

I have always used this analogy. If you go to 3 auctions of similar properties in similar locations on any given weekend, and each auction has 3 successful buyers and 9 underbidders (4 bidders per auction), then the following week only 2-3 similar properties come on. Straight away you have 9 buyers ready to purchase, plus any new buyers that have entered the market in the 3-4 weeks of the new auction campaigns, vying for these properties. Competition increases, consumer confidence increases and, as we have seen many times before, prices start increasing again! The question is, will it be a normal steady increase of 4-8% or will it be 10-15%? Even a steady 5% increase on a $1.5m property is still $75k, I can assure you it is hard to save that amount of money in the space of 3-6 months regardless of how much you earn!

Get in touch with Nuno to find out more about the Inner North/Inner West market, or make an appointment to discuss your requirements and see how we can help you get into your ideal home sooner.

Read more about Nuno Raimundo-

Boroondara – Winter 2024 Market UpdateRead Article

Boroondara – Winter 2024 Market UpdateRead Article -

Melbourne Inner North – Winter 2024 UpdateRead Article

Melbourne Inner North – Winter 2024 UpdateRead Article -

Melbourne Inner West / North – Winter 2024 UpdateRead Article

Melbourne Inner West / North – Winter 2024 UpdateRead Article -

Stonnington – Winter 2024 Market UpdateRead Article

Stonnington – Winter 2024 Market UpdateRead Article -

The History of Merri-bekRead Article

The History of Merri-bekRead Article -

Melbourne Inner North / East – Autumn 2024 UpdateRead Article

Melbourne Inner North / East – Autumn 2024 UpdateRead Article

The first step in your property journey, whether it be buying or selling, is gaining clarity on your situation.