It is hard to believe that we have just stepped out of lockdown 4.0 and, at the time of writing, into yet another one 5.0, and that the first half of 2021 has now been put to bed. We experienced one of the busiest Summer markets ever on the Peninsula with extreme buyer demand, overflowing into Autumn, and now Winter, with buyers patiently waiting on the sidelines for the stock to come.

Holiday-goers from all over Victoria discovered the reason we call the Mornington Peninsula home by exploring the amazing attractions from the renown vineyards throughout Red Hill and Main Ridge, our pubs and restaurants with sensational seasonal food on offer, and finally relaxing and exploring the best that Port Phillip Bay has to offer from bayside beaches to the rugged ocean coastline.

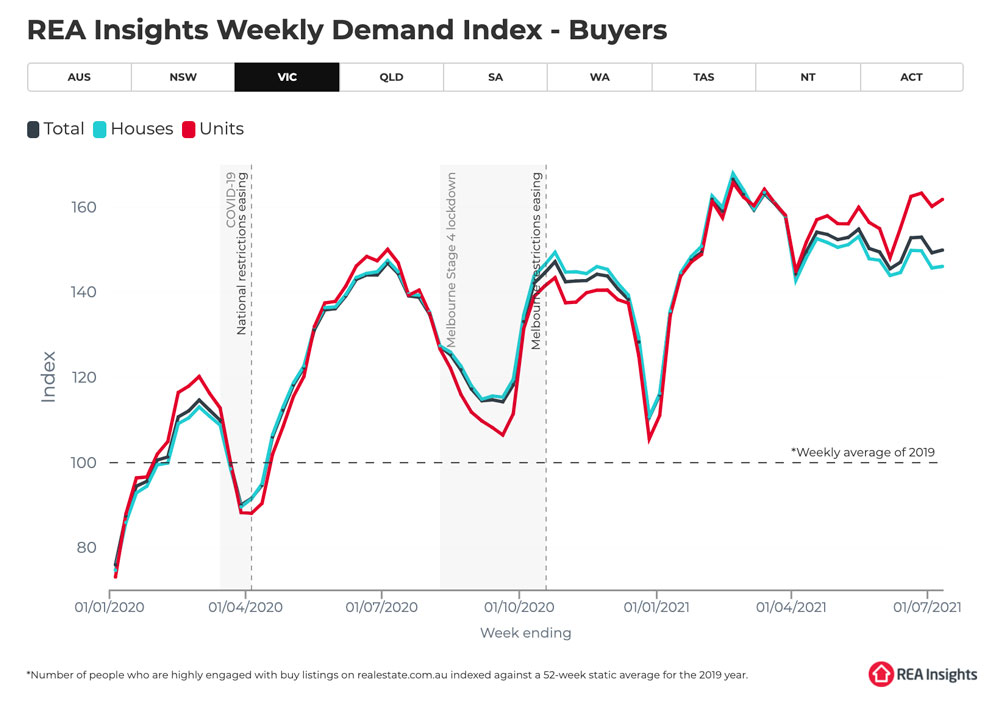

We’ve observed an increased demand for holiday homes since international travel has been temporarily suspended. The ability to generate short term rental income, while also having personal use, coupled with the lowest interest rates in history, has made the prospect of holiday homes and weekenders on the Mornington Peninsula even more attractive than usual. Demand across the entire state, if not country, has been consistently strong since last October. The only momentary dips occurring during a snap lockdowns or school holiday periods as depicted in the REA Insights Weekly Demand Index – Buyers’ report below.

Demand on the Mornington Peninsula is at an all time high for many of the reasons that we have highlighted, and that the fact that many of us are now willing to prioritise a better lifestyle balance that we’ve discovered whilst our movements have been restricted. With this comes an extremely strong demand for stock which has seen days on market reduced to levels that we have not experienced before.

Quite simply, it is a one-dimensional market where sellers mostly hold the power. I will touch on a few examples of this below in the local reports. Properties that have an aspirational aspect are the most sought after. For example, a view of the water or a walk to the beach, a tastefully renovated or staged home that exhibits wow. These types of properties are moving so fast that agent quotes cannot keep up with the rising prices.

Now is the perfect time to engage with BuyerX and plan a strategy for your next move, to avoid rushing into a decision under pressure when opportunities next arise.

Below is an overview of the major million-plus markets on the Peninsula, with apologies to some of the fringe areas which are not featured below (please get in touch for my assessment of these markets if you are interested).

- Northern Tip

- Around the Hill

- Southern End

It certainly doesn’t look like the market on the Mornington Peninsula is showing any signs of slowing down. With everything that we have been through in terms of lockdowns and restrictions, it would have to take a serious economic shockwave to deter the number of out-of-town buyers we are seeing. Interest rates are still at all-time lows, the unemployment rate now sits below 5% in Victoria, and international travel is still a long way off. Despite the strong growth in the past year, there still seems to be good affordability for buyers.

We would expect the Mornington Peninsula to continue its significant growth curve for the second half especially as we head towards spring and back into the warmer weather.

Since coming out of hard lockdown at the end of October 2020, the BuyerX team on the Mornington Peninsula have bought 28 properties for clients, 9 of these have been genuine off market purchases which is an amazing effort in such challenging times.

Contact us see what we have got in the way of off-market listings in our database, there might be one that matches your search brief. Nonetheless, having a local expert on the ground, with a finger on the pulse of prices and knowing where to buy could be the difference between you being successful or missing out. Talk to us today and we will give you an honest opinion of the likelihood of what you are trying to achieve.

Get in touch with Michael to find out more about the Mornington Peninsula property market, or make an appointment to discuss your requirements and see how we can help you get into your ideal home sooner.

Read more about Michael Sier & Jarrod Quint-

Kingston – Summer 2024/25 Market ReviewRead Article

Kingston – Summer 2024/25 Market ReviewRead Article -

Boroondara – Spring 2024 Market ReviewRead Article

Boroondara – Spring 2024 Market ReviewRead Article -

Kingston – Winter 2024 Market ReviewRead Article

Kingston – Winter 2024 Market ReviewRead Article -

Boroondara – Winter 2024 Market UpdateRead Article

Boroondara – Winter 2024 Market UpdateRead Article -

Melbourne Inner North – Winter 2024 UpdateRead Article

Melbourne Inner North – Winter 2024 UpdateRead Article -

Melbourne Inner West / North – Winter 2024 UpdateRead Article

Melbourne Inner West / North – Winter 2024 UpdateRead Article

The first step in your property journey, whether it be buying or selling, is gaining clarity on your situation.