It has been an incredible rollercoaster of a year so far, with twist and turns that nobody saw coming. Despite the sad reality that there have been COVID-19 fatalities, business closures, job losses and stay-at-home orders, there has also been a strong and renewed sense of community spirit and care for each other that possibly was lacking in the past.

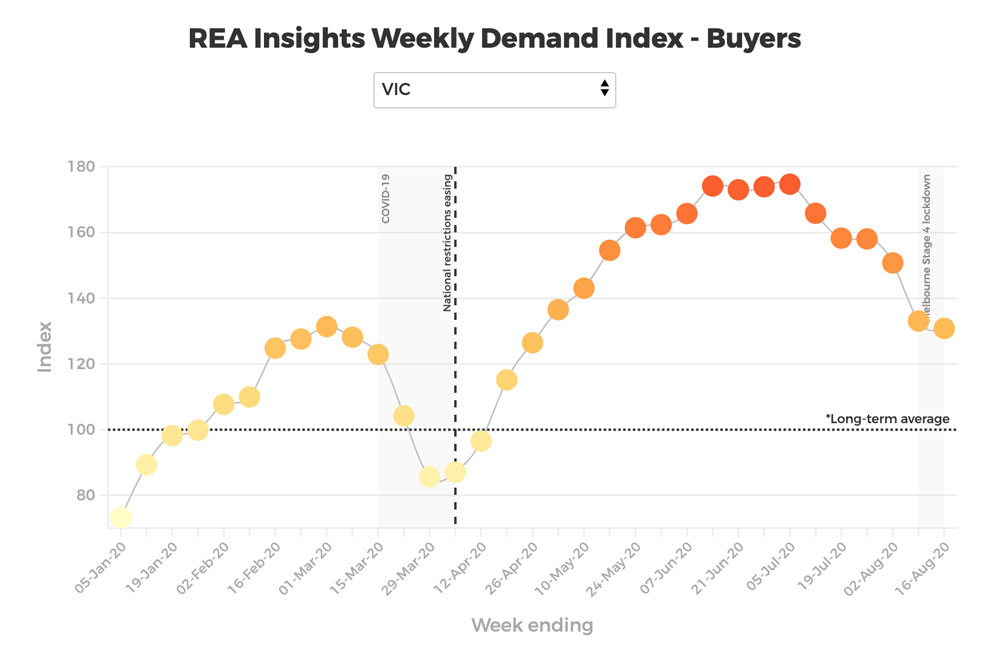

As predicted, the Stage 4 restrictions paused market activity just as Victorians had learned to buy and sell real estate safely and effectively in the new COVID-19 environment. As we came out of the first round of tightened restrictions, what we saw on the ground across the Mornington Peninsula was a pent-up demand for property and a shortage of quality listings. This was felt equally across metropolitan Melbourne and depicted in the REA Insights Weekly Demand Index – Buyers’ report below.

The threat of further restrictions and fear of price falls, coupled with some anxious vendors not wanting to commit to marketing campaigns, drove a large proportion of stock underground into what we call an off-market scenario. Strong agent relationships ensured that our clients were able to transact and take advantage of having representation when other buyers were left in the dark, a result of our experienced advocates understanding how to navigate difficult market conditions.

The large spike in demand from pent-up buyers in Melbourne looking to upgrade, relocate, or buy a holiday home on the Peninsula was the strongest I’ve ever experienced over a winter period. However, we still didn’t get the volume of new listings to meet the increased buyer demand, which put upwards pressure on prices and kept many buyers waiting on the side-lines.

The advice we are giving clients today is to plan for another – and possibly even faster – bounce back to the market. Be ready to take advantage of opportunities as they arise, which may occur at the tail end of this Stage 4 period.

If you’ve got finances in order and are ready to act quickly, you’ll be ahead of the curve when restrictions are eased, and the masses of buyers return to the market. Now is the perfect time to engage with BuyerX and plan a strategy for your next move, to avoid rushing into a decision under pressure when opportunities next arise.

Below is an overview of the major million-plus markets on the Peninsula, with apologies to Mornington, McCrae, St Andrews and Blairgowrie which are not featured below (please get in touch for my assessment of these markets if you are interested). I’ve also omitted August sales from these stats, as transaction activity has not been under normal conditions.

- Northern Tip

- Around the Hill

- Southern End

It certainly doesn’t look like the market on the Mornington Peninsula is showing any signs of slowing down. It would have to take a serious economic shockwave to deter the amount of out-of-town buyers we’re seeing. Prices have risen between 10 and 30 percent from Mt Eliza to Flinders to Sorrento and everything in between. It is extremely difficult to buy property at the moment, you need to be educated, decisive, have a strategy and move quickly. If you’re up in Melbourne, the odds are against you unless you’re able to drop everything at a moments notice and head down the freeway, for the next 6 months which is the average time to buy property down here.

The agents I’m speaking with all have listings ready to launch in mid-January. There will be a period like we saw as we came out of lockdown where stock was listed and snapped up in days. This is likely to happen again towards the end of January as holiday makers turn to sea-changers, and those that missed out in 2020 pick themselves up with renewed confidence and vigour. It will be strong all the way to Easter, and then after that, only time will tell. The COVID-19 vaccine will be making its way through the population of the world and international travel will soon be back on the cards. This may have a cooling effect on the market on the Peninsula, allowing transactions to return to a normal dynamic.

The past 3 out of 5 properties I’ve bought for clients have been off-market. In a rising market, this is almost impossible to do, but with relationships and local knowledge, it can be done. Contact me to see what I’ve got in the way of off-market listings in my database, there might be one that matches your search brief. Nonetheless, having a local expert on the ground, with a finger on the pulse of prices and knowing where to buy could be the difference between you being successful or missing out. Talk to me today and I’ll give you an honest opinion of the likelihood of what you’re trying to achieve. I may even be able to find and secure your dream home, just like I did in 2020 for my successful clients in the hottest market we’ve almost ever seen.

Get in touch with Michael to find out more about the Mornington Peninsula property market, or make an appointment to discuss your requirements and see how we can help you get into your ideal home sooner.

Read more about Michael Sier & Jarrod Quint-

Kingston – Summer 2024/25 Market ReviewRead Article

Kingston – Summer 2024/25 Market ReviewRead Article -

Boroondara – Spring 2024 Market ReviewRead Article

Boroondara – Spring 2024 Market ReviewRead Article -

Kingston – Winter 2024 Market ReviewRead Article

Kingston – Winter 2024 Market ReviewRead Article -

Boroondara – Winter 2024 Market UpdateRead Article

Boroondara – Winter 2024 Market UpdateRead Article -

Melbourne Inner North – Winter 2024 UpdateRead Article

Melbourne Inner North – Winter 2024 UpdateRead Article -

Melbourne Inner West / North – Winter 2024 UpdateRead Article

Melbourne Inner West / North – Winter 2024 UpdateRead Article

The first step in your property journey, whether it be buying or selling, is gaining clarity on your situation.