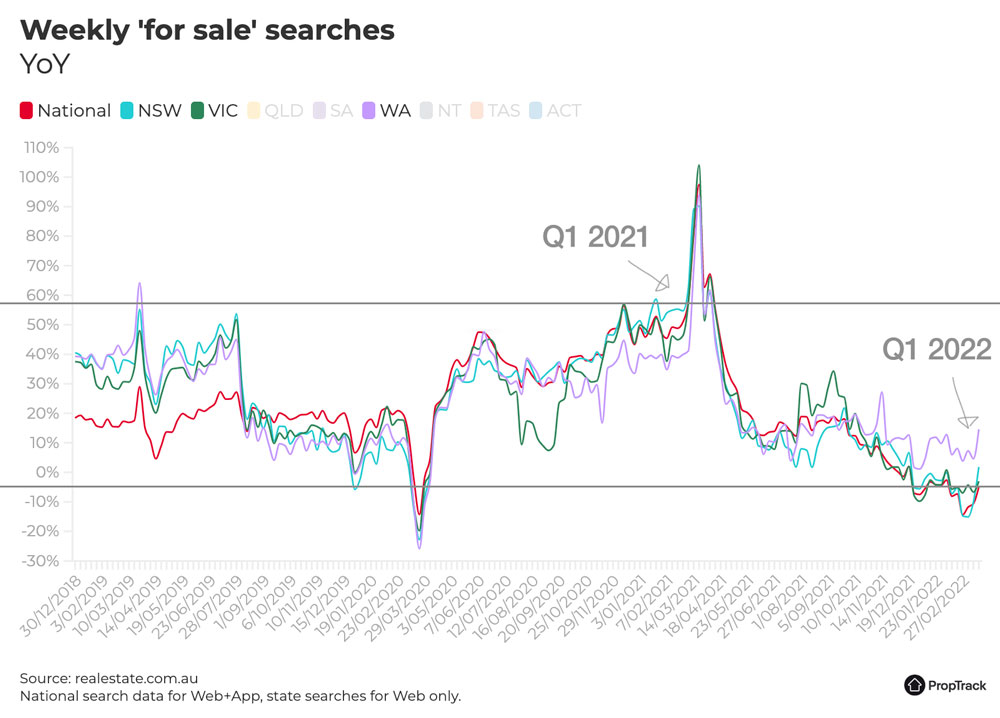

Seasonally, the first quarter always brings a slowing down of activity, though with minimal stock released onto the market this was felt more significantly than normal. The decline attributed by many elements such as the upcoming election, the impact of inflation and looming interest rate rises. The press jumping on the typical sensational story of “price falls” creating negative sentiment within the property market at large. As you can see in the PropTrack weekly search index below, the demand for property searches in Victoria has been on the decline now since the middle of last year.

After the inevitable slowing down of the 2-year “bull market”, buyers that are still looking for property from 12-18 months ago largely viewed this quarter’s property prices as inflated considering the current concerns and kept their hands in their pockets.

Potential sellers have been cautious to list their homes, and those that have by and large have to adjust their expectations. As always, scarcer properties with excellent position, good sized land holdings, or architectural builds retained consistent levels of buyer depth and some still fetched premium prices. Compromised properties, though, that are on main roads, have small land sizes, or are too far from the beaches or public amenities, attracted a reduction in buyers and have extended days on market.

Below is an overview of the major million-plus markets on the Peninsula, with apologies to some of the fringe areas which are not featured below (please get in touch for my assessment of these markets if you are interested).

- Northern Tip

- Around the Hill

- Southern End

The next quarter will mostly likely be a sideways moving market with enough buyers for the available stock, but increased pickiness and fear of overpaying. With less stock and more reluctant buyers, the days of the bull market that saw stiff buyer competition and offers exceeding price guides are gone for now. We will continue to see an elevated concern associated with rising interest rates, though as we know prices do not always fall as a result of these changes. What we will likely experience moving forward is an impact on buyer’s access to credit, with people presently eligible for $1.5m loans unable to borrow more than $1.25m a year from now. This will not necessarily correlate with a 10-15% drop in property prices, it just means buyers’ budgets will reduce. How that will unfold will be a visual shift of buyers moving down a bracket. So those that were looking at $2m properties will be refocusing on those fitting a $1.5m budget, and those looking to purchase $1.5m properties will be looking at $1.3m. Buyers will remain active and wanting to buy, but will be sourcing more homes from the lower end of the market. Overall, there are no panic stations as we head into the next quarter. We are still in a short supply market across the board, but the peninsula is resilient and always slightly insulated from what’s happening in the economy so will retain its buoyancy. It tends to be a market where, particularly at the top end, houses don’t change hands very often, so we rarely see a flood of stock hit the market unless things get really bad in the economy.

These changing market conditions place the onus on the agent to set realistic price guides that better reflect the needs of the seller while also incentivising the buyer. Vendors that keep highballing property prices without the scarcity or A grade factors will blow out their days on market. In sticking with a well-worn pattern, A grade will remain unaffected. As is common in times of uncertainty, vendors will rely more heavily on off-market listings to test the waters through the agent’s available database in a more non-committal selling strategy style.

While there are always a number of these off-market listings within each suburb, there are risks involved in these purchases, and while within an open market you can see what your competition is willing to pay, these listing do not always reflect true market value. This further highlights the importance of a buyer’s agent in providing an invaluable opportunity for buyers to source the property that suits their brief, void of competition, while also ensuring due diligence is undertaken and a fair sale price is reached. We have quite a number of off-market properties in our database currently, some A grade, while others not meeting our tough standards.

Get in touch with Michael to find out more about the Mornington Peninsula property market, or make an appointment to discuss your requirements and see how we can help you get into your ideal home sooner.

Read more about Michael Sier & Jarrod Quint-

Kingston – Summer 2024/25 Market ReviewRead Article

Kingston – Summer 2024/25 Market ReviewRead Article -

Boroondara – Spring 2024 Market ReviewRead Article

Boroondara – Spring 2024 Market ReviewRead Article -

Kingston – Winter 2024 Market ReviewRead Article

Kingston – Winter 2024 Market ReviewRead Article -

Boroondara – Winter 2024 Market UpdateRead Article

Boroondara – Winter 2024 Market UpdateRead Article -

Melbourne Inner North – Winter 2024 UpdateRead Article

Melbourne Inner North – Winter 2024 UpdateRead Article -

Melbourne Inner West / North – Winter 2024 UpdateRead Article

Melbourne Inner West / North – Winter 2024 UpdateRead Article

The first step in your property journey, whether it be buying or selling, is gaining clarity on your situation.