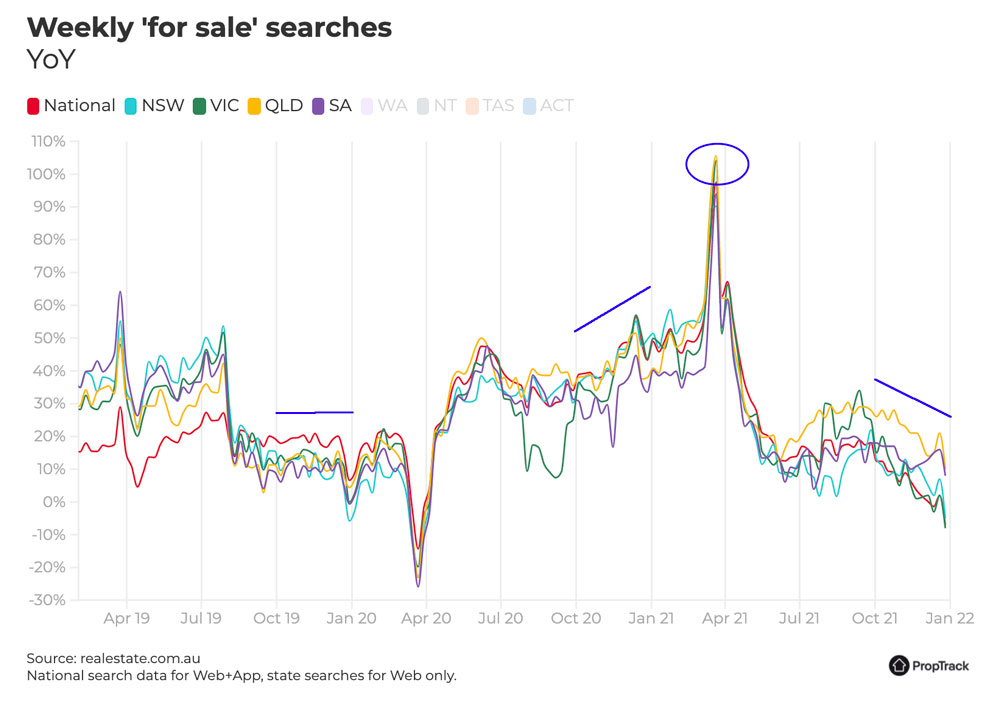

2021 was a year punctuated with Coronavirus-shaped curveballs, and the longest lockdown on record. Somehow, amongst it all, the property market thrived. The macro conditions favoured the bold, as the lowest interest rates in history, minimal regulatory intervention, low unemployment, and soaring consumer confidence, saw the challenges of the virus inexplicably take a back seat. Thus began the most aggressive buying conditions this market has ever experienced.

January and February began with a bang. It is a special market indeed that allows you to buy and sell within a year and make a 25% financial gain. Buyers had to be quick, as properties were sold within days of going on market for well above the suggested price guide. One of the most difficult elements to navigate was the pervasive tone of disappointment and frustration from buyers unable to break into the market. Agents bore the brunt of this high emotion, as well as the pressure from sellers for higher sale prices.

Oscillating between lockdowns, confirmation came that looking at property was an approved activity. As Chad Egan from Cobden Hayson said, “We saw one of the highest growth rates of property in NSW that no one could have predicted, whilst also enduring four months of lockdown”. This was the pinnacle of the property bull market, as both buyers and sellers came out at a frenetic pace. Agents were juggling a high level of one-on-one inspections with online auctions, processing and finalizing sales while the vast majority of society remained behind closed doors.

The demand skyrocketed, and standard four week auction campaigns were reduced down to two week selling cycles, averaging seven buyers per auction. Matthew Hayson from Cobden Hayson explains more, “We topped the market for the year with 48 registered buyers for one auction in Ashfield, and that’s the type of data we may only see once every 10 years. Through the lockdowns we also averaged an increase of 16% above the reserve which was being set by sellers. Price growth was rocketing up between 3-5% per month”. “It was time for most people to cash in and make a move irrespective of current position. Some re-sales we had one year on made up to 40%”, said Michael White, Bresic Whitney.

When Sydney finally came out of months of lockdown the sense of urgency had come out of the market, with discussion of interest rates inevitably returning to previous levels, asset values at an all-time high, a flooding of available listings, and a generalized buyer fatigue. November reflected this, with the lowest increase in growth for the year, at a modest 0.9%.

Demand in the Inner West of Sydney has come off its all-time high for many of the reasons that we have highlighted, but it has been a very long 12 months. It may be more balanced across the board than before, but sellers generally still seem to have a slight advantage.

Now is the perfect time to engage with BuyerX and plan a strategy for your next move, to avoid rushing into a decision under pressure when opportunities next arise.

Below is an overview of the major markets in Sydney’s Inner West, with apologies to some of the fringe areas which are not featured below (please get in touch for my assessment of these markets if you are interested).

- Lower Inner West

- The Bay Area

- City Fringe

As the holiday period led into the new year, buyer sentiment shifted. On the back of media coverage suggesting that interest rates will be increasing, buyers have begun holding back anticipating a resulting market drop. The rollercoaster of price increases and market uncertainty has calmed. Adrian Tsavalas from Adrian William Real Estate observes, “As we entered 2022 a backlog of homes hit the market, diluting the buyer pool”. The year ahead may be different, if indeed interest rates to increase we might see a stock level increase that will force some vendors to come to market. Sellers need not fret as yet, as buyer demand is still very high with approximately 30-40 views at each open house. Asset prices are still up 25-30%, and A grade properties continue to demand premium prices, though they must now take the reduction in buyer demand into account in their expectations and negotiations. Says Alex Mastoris from Cobden Hayson, ”Though it is still too early to predict the year ahead, our core area of the Inner West has always fared well through the highs and lows. I don’t believe that we are in for any major correction. Instead, I believe we will see a normal trading pattern in the coming year”.

As the market shifts, buying strategies also need to be reviewed regularly. We get access to homes off-market every week, and help our clients navigate the peaks and troughs so that the right property is bought for the right price. Get in touch with Hamada for an obligation free chat about your search today.

Get in touch with Hamada to find out more about the Sydney Inner West property market, or make an appointment to discuss your requirements and see how we can help you get into your ideal home sooner.

Read more about Hamada Alameddine-

Kingston – Summer 2024/25 Market ReviewRead Article

Kingston – Summer 2024/25 Market ReviewRead Article -

Boroondara – Spring 2024 Market ReviewRead Article

Boroondara – Spring 2024 Market ReviewRead Article -

Kingston – Winter 2024 Market ReviewRead Article

Kingston – Winter 2024 Market ReviewRead Article -

Boroondara – Winter 2024 Market UpdateRead Article

Boroondara – Winter 2024 Market UpdateRead Article -

Melbourne Inner North – Winter 2024 UpdateRead Article

Melbourne Inner North – Winter 2024 UpdateRead Article -

Melbourne Inner West / North – Winter 2024 UpdateRead Article

Melbourne Inner West / North – Winter 2024 UpdateRead Article

The first step in your property journey, whether it be buying or selling, is gaining clarity on your situation.