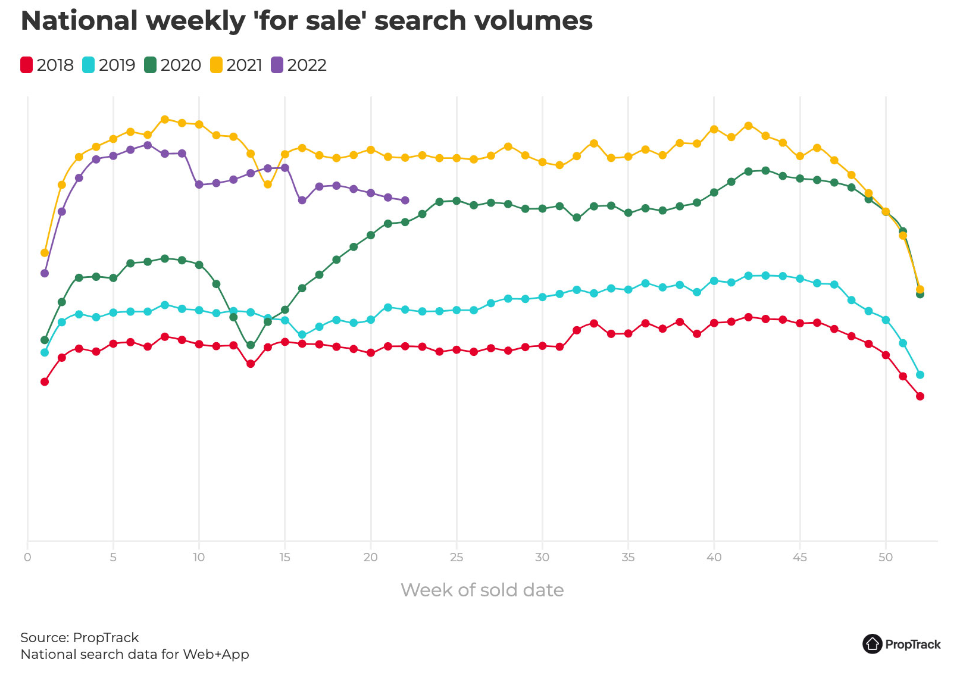

The real estate market within the Mornington Peninsula is seasonally dependant, with the colder months reflecting lower activity than normal. So, a quietening across the board this quarter was no real surprise. However, it was unforeseeable that inflation would blow out to more than twice that of the RBA’s target, requiring successive and aggressive cash rate increases to adhere to their monetary policy. With uncertainty on how high and how long inflation will continue to stay above the RBA target, both buyers and sellers have become apprehensive to make decisions, resulting in an already seasonally low volume market further impacted by seller reluctance.

There are, however, advantages to be found in this market shift. With increased flexibility in vendor expectations, offer conditions and less competition, for buyers looking to upgrade the reduced gap between their sale price and purchase price provides for optimal conditions.

Unlike last year, when coming out of lockdowns saw properties selling within a matter of days forcing buyers to take a punt or buy after one inspection, the slower pace of this year presents the opportunity for a more considered approach. Quentin McEwing of McEwing & Partners elaborated on this sentiment, further explaining that markets can alter quickly, and trying to time an entry and exit can be difficult. “We are seeing a division in the property market. The higher end discretional spend is still strong. We have buyers looking for premium waterfront homes with buyer budgets up to $15-$20m. However, the enquiry on the middle to lower market has stalled. Buyers are wanting to wait and see the ramifications of the RBA’s counter measures to inflation. Hoping the increased costs of borrowing and subsequent serviceability issues that it will have on current debt will bring property prices back. With that we are now seeing stock levels replenish and days on market extended. If I was a buyer in today’s market, I’d be out there now taking advantage of less competition and greater choice.”

- Northern Tip

- Around The Hill

- Southern End

Moving forward, the next quarter will probably be more of the same as we wait and see how changing conditions will reflect on the market. The pervadingly negative market sentiment present this quarter will likely continue due to sensationalised media reporting. A common occurrence following a rising market such as this, is the constant dissemination of information broadcasting the skyrocketing rate rises, mixed with every single slight drop in prices, creating heightened buyer and seller reluctance.

It is important to note that median price falls do not necessarily translate to the value of a specific property falling, only that the mid-point of a collective of properties selling in that time period is less. It would be remiss to pay too much attention when it is “dropping” by a few % and the media reports the market has fallen 2 months in a row, particularly when the sample size of sales is so low. The proportion of higher or lower value properties, i.e., the quality of the properties from one month to the next might be vastly different. The Peninsula is not a high supply market, so regardless of these circumstances it’s unlikely we will be flooded with properties if rates continue to rise.

As Madeline Kennedy, of RT Edgar, pointed out, scarce listings will continue to be in demand, “As always, if you find a property that ticks the right boxes for you and is reasonably priced, don’t hang out for the market to drop. Doing so will mean you’ll probably have more competition from other buyers and either pay more or miss out! Sellers who invest in presenting their home well, choosing the right professional adviser to represent them and pricing it to the market will be rewarded with a successful sale.”

So, while price growth will likely track sideways from here until Christmas, if rates stay at an affordable level there is every potential for more activity and even some price growth as the warmer weather arrives. If you are a buyer on the sidelines, the best opportunities will be before you in this low activity period, as once the market starts to recover, buyers will return quickly and you’ll be having to compete once again.

Get in touch with Michael to find out more about the Mornington Peninsula property market, or make an appointment to discuss your requirements and see how we can help you get into your ideal home sooner.

Read more about Michael Sier & Jarrod Quint-

Kingston – Summer 2024/25 Market ReviewRead Article

Kingston – Summer 2024/25 Market ReviewRead Article -

Boroondara – Spring 2024 Market ReviewRead Article

Boroondara – Spring 2024 Market ReviewRead Article -

Kingston – Winter 2024 Market ReviewRead Article

Kingston – Winter 2024 Market ReviewRead Article -

Boroondara – Winter 2024 Market UpdateRead Article

Boroondara – Winter 2024 Market UpdateRead Article -

Melbourne Inner North – Winter 2024 UpdateRead Article

Melbourne Inner North – Winter 2024 UpdateRead Article -

Melbourne Inner West / North – Winter 2024 UpdateRead Article

Melbourne Inner West / North – Winter 2024 UpdateRead Article

The first step in your property journey, whether it be buying or selling, is gaining clarity on your situation.