As the 2021 real estate year comes to an end, we reflect on the unique year we just had, the highs and lows, and the predictions that nearly everyone including economists got wrong. We all endured more lockdowns, some of us had the additional stress and time constraints of home-schooling, whilst others continued the unpredictable restrictions on workplaces and businesses. All the while, the Mornington Peninsula property market continued to defy any fear of job losses and industry shutdowns, with extreme growth driven by high demand and low supply.

Metropolitan Melbourne (which rightly or wrongly includes the Mornington Peninsula) was forced into tight real estate restrictions yet again over the winter months, mirroring the ban on inspections that we faced in 2020. This led some buyers yet again to purchase properties sight unseen – a dangerous tactic particularly on homes that carry significant value in the building.

The Mornington Peninsula surged ahead of the rest of Melbourne in terms of price growth, with some beachside suburbs experiencing growth of more than 40% over the previous 12 months. St Andrews Beach, Portsea and Rye being good examples of markets that had a huge increase in price growth. The former two were driven by a short supply, but the latter, Rye, became the affordable compromise market that attracted holiday home buyers looking for an escape from the daily grind.

In the 12 months prior, Blairgowrie had been the star performer, where land prices hovered around $1,500 per sqm. Fast forward to the middle of 2021 and land prices had surpassed 2,000 per sqm. This level now challenged Sorrento and consequently, buyer depth dropped away. The ripple effect meant that priced-out buyers were now looking at Tyrone Foreshore in Rye for some price relief whilst still having proximity to the quieter beaches and village.

St Andrews Beach and Portsea are perennial short supply markets and had come off long periods of subdued growth, therefore were due to catch up, but I don’t think anyone predicted the level that buyers were prepared to push prices. I’ll go over some specific results in the local market wraps below, but so far as to say that agents had all sorts of trouble quoting listings going to auction.

As we came out of our snap 7-day lockdown that lasted 12 weeks, overhanging properties were once again snapped up quickly and any hopes of more balanced supply were quashed when new listings only came through in dribs and drabs. As we approach the end of the year, buyer enquiries have dropped off according to most agents I have spoken to, and there’s a feeling of a more balanced status quo.

Enter Omicron, a new strain to test the market a third time. We saw the Alpha and then Delta variants have a positive effect on buyer demand, will we see this again in the new year? Enter the current inflation problem and mortgage fixed rate increases, which always signal the banks’ view on what the RBA will do in the future. Also enter the Federal Election, which has a history of cooling property markets. Will we see the market continue to grow, or have we now reached a ceiling? Which way will it go from here?

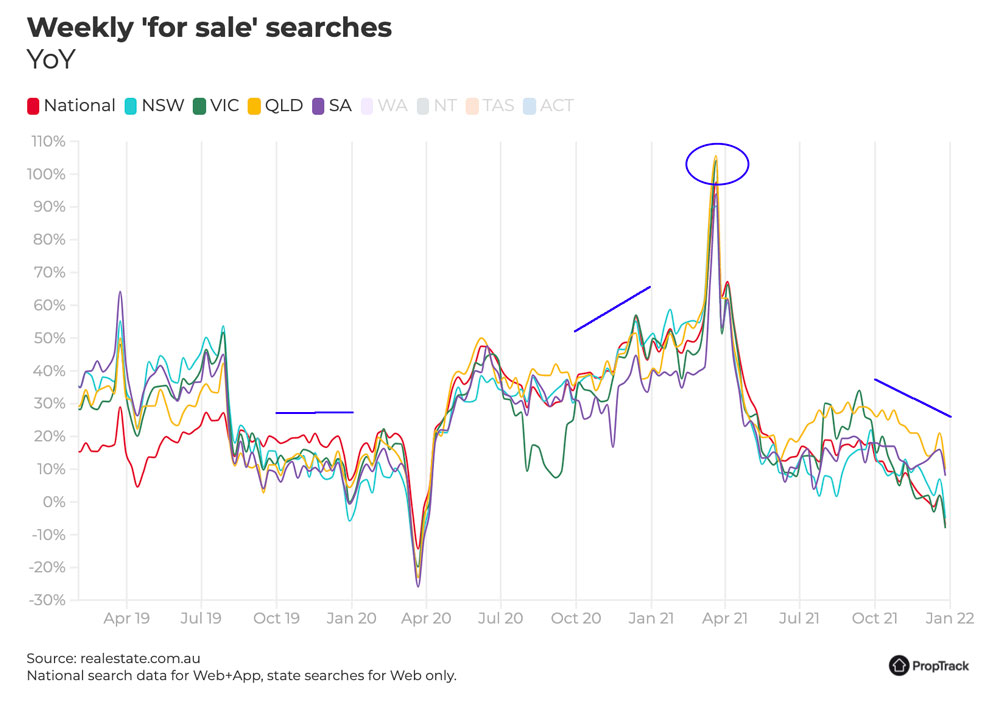

As we can see in the PropTrack weekly searches index (replacing the REA demand indicator) we can see the activity from buyers across the last quarter of the year for the past 3 years. The trend in 2019 was a balanced market, the last quarter of 2020 was a high demand market, and finally this year in 2021, the buyer demand has trended down to finish the year at the same demand levels as 2019. Could this be the signal that we’ve now returned to a balanced market? As I had written in my mid-year update, I believed the top of the market was reached in March/April, and this can be seen where I have circled the peak of the search demand. Yes, we were subjected to lockdown for 3 months during winter, but the drop in demand from April to July was evident that buyers were starting to keep their hands in their pockets.

Demand on the Mornington Peninsula has come off its all-time high for many of the reasons that we have highlighted, but it has been a very long 12 months and you could argue that everyone is tired, needs a break, and is focussed on a well-derserved family holiday. Nearly all the agents I deal with have taken time off this January, some away for a few weeks – which is a signal to me that not only has the heat come off a little bit, but they really need a break.

I am now questioning who holds the power, it has been the sellers for a good 12-18 months. I have a feeling this is now swinging back in the favour of buyers, but I am not yet calling it a “buyers market”. It may be more balanced across the board than before, but sellers generally still seem to have a slight advantage.

Now is the perfect time to engage with BuyerX and plan a strategy for your next move, to avoid rushing into a decision under pressure when opportunities next arise.

Below is an overview of the major million-plus markets on the Peninsula, with apologies to some of the fringe areas which are not featured below (please get in touch for my assessment of these markets if you are interested).

- Northern Tip

- Around the Hill

- Southern End

It has been a rollercoaster of a year on the Mornington Peninsula, but agents, vendors, and buyers have adapted to the market environment with little commotion. Timid buyers who waited to see what the market was doing have been priced out of areas they started their searches in. Other buyers who were brave, and possibly felt they were overpaying at the time, are now sitting on 30% additional equity from the start of the year. We guided over 40 clients this year through the process and many conversations were had regarding “what-ifs”. Having the market knowledge, relationships with the agents, experience in difficult situations, and access to homes off-market have put those 40 clients in a great position moving forward.

It isn’t clear how long we will continue to see the market across the Peninsula enjoy the same buoyancy that we’ve seen for the past 12-18 months, but the data shows buyer depth is still strong enough on the low stock volumes to support price growth. If we have an increase in supply, we may start to see some stagnation, but I doubt we will see any retracement in price. Affordability is now being challenged, and as interest rates look likely to rise later this year, it may put the brakes on price growth – regardless of listing volumes. A-grade homes will continue to have demand from buyers, and that’s where savvy buyers will focus this year.

Contact us see what we have got in the way of off-market listings in our database, there might be one that matches your search brief. Nonetheless, having a local expert on the ground, with a finger on the pulse of prices and knowing where to buy could be the difference between you being successful or missing out. Talk to us today and we will give you an honest opinion of the likelihood of what you are trying to achieve.

Get in touch with Michael to find out more about the Mornington Peninsula property market, or make an appointment to discuss your requirements and see how we can help you get into your ideal home sooner.

Read more about Michael Sier & Jarrod Quint-

Kingston – Summer 2024/25 Market ReviewRead Article

Kingston – Summer 2024/25 Market ReviewRead Article -

Boroondara – Spring 2024 Market ReviewRead Article

Boroondara – Spring 2024 Market ReviewRead Article -

Kingston – Winter 2024 Market ReviewRead Article

Kingston – Winter 2024 Market ReviewRead Article -

Boroondara – Winter 2024 Market UpdateRead Article

Boroondara – Winter 2024 Market UpdateRead Article -

Melbourne Inner North – Winter 2024 UpdateRead Article

Melbourne Inner North – Winter 2024 UpdateRead Article -

Melbourne Inner West / North – Winter 2024 UpdateRead Article

Melbourne Inner West / North – Winter 2024 UpdateRead Article

The first step in your property journey, whether it be buying or selling, is gaining clarity on your situation.