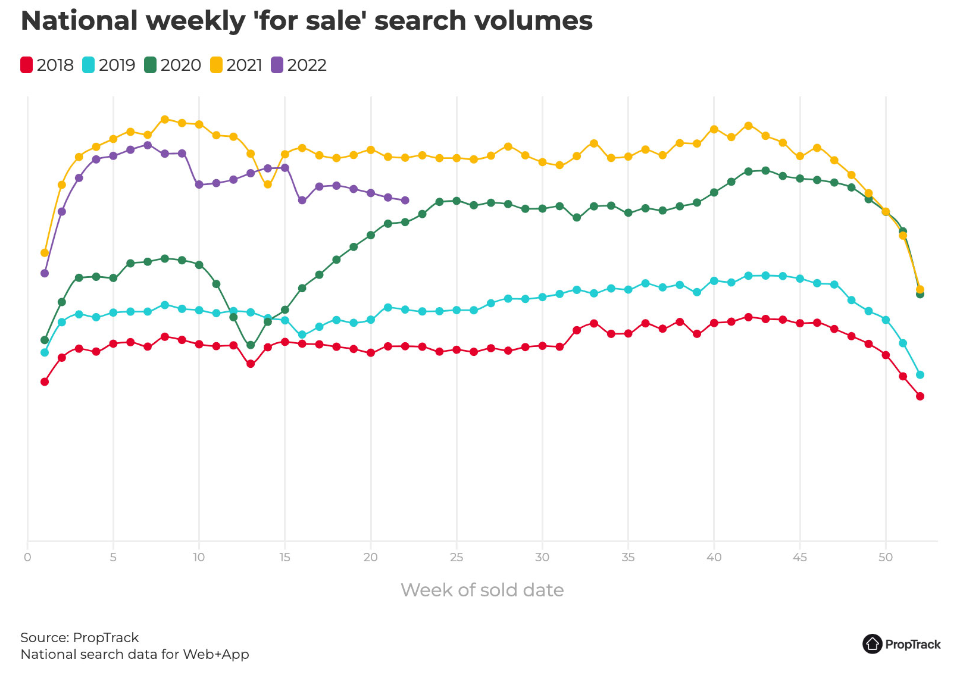

Another turbulent quarter has passed, with the property market seemingly at the mercy of the RBA. As it began to front load rate hikes, the tone and stance throughout the market went through a belt tightening of its own. Though context is key, as price gains throughout the 2021 bull market could not be sustained long term regardless. After Sydney property prices surged by up to 25% during this period of record low interest rates, it was a natural expectation to see a contraction in property prices on the back of the reintroduction of interest rate rises. Sydney’s average home prices topped the national statistics at a decline of 1% in May.

As borrowing capabilities greatly reduced through interest rate bumps, spending was impacted and offers lowered, forcing vendors to reduce prices in order to secure deals. Vendor discounting was driven upward from 2.9% in September-November 2021 to a current level of 3.3%. Adrian Tsavalas from Adrian William Real Estate stated, “Buyers were fearful of rising interest rates and many factored future market losses into their offers. The uncertainty caused vendors to hold off listing their properties and therefore kept stock levels relatively tight”. Sales volume dropped by 26% in May this year, compared to the same month last year, while the median days on market rose to 28, up from 20 days late last year.

Consumer confidence has taken a massive hit. Michael White from Bresic Whitney stated, “The same buyers attitude has been around for the past 3 months, i.e. I don’t want to overpay as I feel there will be more pressure on the market over the coming 6 months as interest rates rise. Whereas 6 months ago the banks were yet to reduce their borrowing power so it felt more comfortable”. Brandon Nguyen from Bresic Whitney reflected this sentiment towards the changing market, “Whilst this was a quieter quarter, and the year looks to be a more cyclical market, buyers with strong motivation continued to transact. Others decided to sit on the sidelines and wait for the spring market, which we feel should bring more stock to the market”.

Despite the uncertainty, less buyer competition and dropping prices resulted in a flip from the strong sellers market of 2021 to a buyers market in most areas. David Eastway from Hudson McHugh offered this insight, “Whenever there is a dip in the market it’s the right time to buy. The last dip was 2018/2019 with the royal commission. The unfortunate thing about upsizing in a falling market is this; if you own a unit or small home that is compromised you may have lost 15-20% in value in the drop. If you are trying to upsize to a larger and more premium home, that house may hold its value better so may have only dropped 5%. So the gap gets bigger, making it harder to upsize. You can try to time the market (impossible) and sell, wait 6-12 months in the hope that it continues to fall, then buy back in. That’s where you can upsize with ease. Though many vendors do not like the risk this presents”.

For those whose financial capacity allowed them to take advantage of the benefits of upgrading during a downturn, who were able to overcome the growing pressure on budgets and restrictions through inflation, trade shortages and the like, there were valuable wins to be had. Matt Hayson from Cobden Hayson also encouraged investment through this period, “We are currently advising our clients to look for properties with some size that require work, as buyers are shying away from these opportunities or being overly aggressive with their price feedback. Therefore, we are seeing good opportunity for these properties, particularly if they have good foundations such as the street, potential, parking, aspect or land area. You just need to be willing to do some work. Our advice is to pause, live in the property, let this inflation period blow past and then start to do work in a year or two”.

- Lower Inner West

- The Bay Area

- City Fringe

Depending on the speed and magnitude at which the RBA continues to raise the cash rate, estimated at 2.1% this year, housing prices could contract significantly. Current industry predictions indicate a fall of 11% and 18% by the close of 2022 and 2023 respectively. As for the next quarter, traditionally it presents a quietening as winter takes hold. As David Eastaway from Hudson McHugh said, “Winter is always quiet. Stock levels are lower in rentals and sales. People tend to hibernate, except for the past 2 years with COVID. We will see a return to the usual trends with more stock heading into the warmer months”.

Matt Hayson from Cobden Hayson gives his forward view, “Buyers will fall further into a winter malaise. Rates will increase, the narrative in the media will get darker, CoreLogic will report of quickening price declines across Sydney and this will negatively impact buyer sentiment. Moreover, quality listings coming to market are limited and this will almost ensure buyer excitement levels will be at an all-time low. Maybe we’ll see a shake up with an increase in property later in the year but by that stage we’ll be working in a higher cash rate environment that may negate any positivity. We expect the year to be a tough one for sellers and opportunities for seasoned buyers will increase”.

Though the pendulum does appear to have firmly swung in favour of the buyer, this will not be an easy time for either party. As a result, many buyers will hold off in the hope of a better deal. This ‘watch and wait’ pattern has gained momentum in line with rising interest rates reducing buyers borrowing capacity. With the booming property prices of the bull market behind us, home owners will increasingly hold onto their properties in the hopes of market recovery, which will present a strong risk to buyers of limited choice in the coming months. Success in this current market requires a focus on the asset, not the market. In having a clear understanding of your non-negotiables and a structured buying strategy. While we are mindful of the changing conditions and effects on buyers, our recommendation to clients is that if a property has got as many of the non-negotiables as you would like, and is priced within a budget you are comfortable to pay, then it will always be the perfect time to execute regardless of what’s going on in the market.

Get in touch with Hamada to find out more about the Sydney Inner West property market, or make an appointment to discuss your requirements and see how we can help you get into your ideal home sooner.

Read more about Hamada Alameddine-

Kingston – Summer 2024/25 Market ReviewRead Article

Kingston – Summer 2024/25 Market ReviewRead Article -

Boroondara – Spring 2024 Market ReviewRead Article

Boroondara – Spring 2024 Market ReviewRead Article -

Kingston – Winter 2024 Market ReviewRead Article

Kingston – Winter 2024 Market ReviewRead Article -

Boroondara – Winter 2024 Market UpdateRead Article

Boroondara – Winter 2024 Market UpdateRead Article -

Melbourne Inner North – Winter 2024 UpdateRead Article

Melbourne Inner North – Winter 2024 UpdateRead Article -

Melbourne Inner West / North – Winter 2024 UpdateRead Article

Melbourne Inner West / North – Winter 2024 UpdateRead Article

The first step in your property journey, whether it be buying or selling, is gaining clarity on your situation.